Following its first REMA consultation that ran from 18 July 2022 to 10 October 2022, on 7 March 2023 the government published a summary of the consultation responses and its updated policy position with regards to the options set out. See here for our reaction to this.

It outlined some options for reform that it will not be taking forward and others that it will not take forward as standalone mechanisms but that are being considered alongside other reforms. It considers that this an important step in the process to provide clarity for investors.

March 2023 options for reform

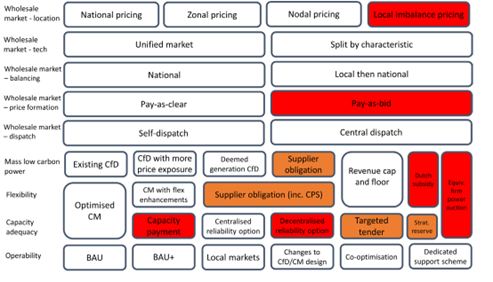

Based on the feedback received, the government decided in March 2023 not to take forward six options into the next round of assessment (highlighted red in Figure 1) in the REMA programme. It has also discounted a further three as standalone options (highlighted orange in Figure 1), but which are being considered in conjunction with other reforms.

Source: DESNZ

Responses

225 responses to the first consultation were received from a range of participants across the electricity market, including wider stakeholders. For the most part, responses were from electricity generators and developers, however, representative organisations, energy infrastructure, academia, suppliers, and private individuals were also “well-represented.”

Programme design and cross-cutting issues

Chapters 1-4 of the first consultation response cover REMA’s “vision for market arrangements”, with the first consultation raising questions on a number of “programme design and cross-cutting issues.”

Largely, the responses in this section were positive as most respondents agreed with REMA’s overarching vision and approach to reforming market design. As such, 92% of respondents agreed that “REMA’s objectives are appropriate as guiding principles” with a further 83% agreeing that as current market design is not sufficient, REMA was “right” to consider changes which could deliver “decarbonisation, security of supply and value for money.” However, it was also noted that consumer impacts should be taken into consideration alongside the establishment of a “clear pathway to reform” in order to avoid an “investment hiatus.” Responding to this, the government maintained that while REMA’s overall vision and objectives are appropriate to the needs of the first consultation, it will assess whether any update is necessary for the next phase of the Review. Moreover, the government has noted the need to better reflect consumer impacts and the “need to take a whole-system approach.”

Overall, respondents (80%) also made clear that current market arrangements are unsuitable and will not be able to deliver a decarbonised power sector by 2035. Moreover, a further 80% agreed that the Review had identified the correct challenges facing the electricity system. There were caveats as some deemed locational pricing signals “unnecessary with sufficient network build”, while others made clear the need to distinguish between desirable and undesirable price volatility. Taking this into account, the government has agreed that while their original case for change remains valid, additional options must be considered. This will either be presented in a separate “formal update” or will be made clear in the next phase of the Review.

68% of respondents wholly agreed with REMA’s options assessment criteria (least cost, deliverability, investor confidence, whole-system flexibility, and adaptability) with many instead preferring “best value” over “least cost” as it has longer-term implications and would ensure that decisions are not solely made on the basis of low cost. Respondents were also keen to highlight the importance of the investor confidence criterion as it is essential that REMA delivers long-term clarity and certainty. 72% of respondents found the schematic or ‘map’ (Figure 1) of proposed changes clear and understandable, highlighting areas of synergy or overlap. Some of those who disagreed, felt that it was “insufficiently holistic” or that it was too complex, preferring a simpler market design. Regarding complexity of any proposed market redesign, some respondents warned against “creating barriers to entry” or negatively impacting investor confidence, potentially leading to an investment hiatus. The government has thus concluded that “overall system value” should be included in the options assessment criteria and that “least cost” should not be understood to mean short-term cost minimisation. Furthermore, the government agrees that reducing complexity is important and that incremental reforms should be prioritised over transformational ones and have thus removed six of the options originally considered in the first consultation.

Cross-cutting issues were another area of concern, as only 57% of respondents agreed that REMA had identified them correctly. For the most part, those who disagreed found that REMA did not give sufficient consideration to consumers, nor did it align itself with the ongoing retail market review. Other respondents suggested consideration of “network investment and access, the interactions between wholesale and retail markets, and the role of central planning.” Following this, only 53% of respondents found that REMA had adequately assessed the trade-offs between different approaches to solving cross-cutting issues.

Many areas of contention were highlighted here as respondents raised issues with marginal pricing, the role of the market, the extent of decentralisation, and the extent of competition. In response, the government has noted that while retail markets and network investment are outside the formal scope of REMA, they will continue to work alongside Ofgem and the Department of Energy Security and Net Zero (DESNZ) to ensure cohesion. The government will also work to “sharpen locational signals” and “further map key interdependencies between wholesale and retail reform and establish a new forum that will seek the input from end users and consumer groups on overall electricity market reform.”

Wholesale markets

The first consultation set out several options for delivering net zero wholesale market arrangements, with the majority of respondents (52%) agreeing that all credible options for reform are being considered.

The government decided to retain all options proposed relating to wholesale markets for the next stage of assessment, with exception of pay-as-bid pricing across the entire market and local imbalance pricing (Figure 1). Respondents were divided on continuing to consider pay-as-bid pricing, with recommendations made to discount this option, and some respondents mentioning alternative approaches to decoupling gas and electricity prices, such as CfD and splitting the wholesale market.

Likewise, respondents were split on the option to adopt a local markets approach, with 39% disagreeing and 44% agreeing to continuing to consider this option. Based on the feedback received, the government considered that neither of these options meet the criteria of least cost and investor confidence. As such, while it will not continue to consider these options, going forward it said that other options for decoupling electricity and gas prices for some generators will be considered, as well as options that could send locational price signals.

On the options to be retained, most respondents (75%) agreed with continuing to consider incremental reforms to wholesale market arrangements, including dispatch, settlement and gate closure, with some feeling that it could be preferable to more drastic changes. Responses around the more transformative options under consideration were mixed, including those on whether the government should continue to consider the option to split the wholesale market, either by creating “on-demand”, “as-available” markets, or by implementing a green power pool. Responses were also mixed with regards to zonal and nodal pricing, with the majority (55%) of the opinion that the government should not consider both options.

Of these, some rejected both options, noting concerns that they would undermine investor confidence, risking an investment hiatus in renewables, and potentially hinder the energy transition, while others preferred to retain zonal pricing only. Some respondents suggested alternative options to nodal and zonal market designs, such as reforming Transmission Network Use of System (TNUoS) charges or adding locational signals to the CfD scheme. In its response, the government said that it considers there is merit in continuing to consider both zonal and nodal pricing, alongside less transformative options (i.e. minor reforms to network charging arrangements) while evidence is gathered on their potential costs and benefits.

Mass low carbon power and demand reduction

Options for delivering mass low carbon power were considered in the first consultation, with 48% of respondents agreeing that the government has considered all credible options for reform, while 35% disagreed and some presented further options for CfD reform. A few respondents also highlighted the importance of Power Purchase Agreements (PPAs) and the potential for them to be a credible alternative to a CfD in driving mass low carbon generation investment. In response, the government said that it is considering whether it could stimulate the PPA market and what form this could take.

The government decided to continue to consider all options under both central contracts with payments based on output and central contracts with payment decoupled from output. Most respondents (72%) agreed that both options for central contracts based on output should be considered as the primary mechanism for deploying mass low carbon power. This includes minor reforms to the existing CfD and a CfD with more price exposure. However, some were of the view that solely incentivising output was not appropriate. With regards to central contracts with payment decoupled from output, the majority (65%) of respondents agreed that financial support mechanisms not linked to low carbon generator output should continue to be considered.

The government said that it will not take forward the option of a supplier obligation to drive investment in low carbon power in the short-term as a standalone option (Figure 1), based on the feedback received and interdependencies with other ongoing market reviews. 48% of respondents disagreed with continuing to consider a supplier obligation, with some stating that this would increase supplier capital costs and hamper the rollout of low carbon generation, with a few also noting that it could disadvantage smaller suppliers. Of the 42% that agreed with continuing to consider a supplier obligation, a few stated that it could help to drive innovative supplier business models, improved signals and new technologies. Of the 10% that neither agreed nor disagreed, a few mentioned the need to wait for the outcome of the government’s Future of the energy retail market: call for evidence. It noted that it will continue to consider the role of suppliers for other REMA options.

Flexibility

The first consultation considered a range of options related to incentivising flexibility within electricity market arrangements, with 44% of respondents in agreement that the government is considering all credible options for reform.

There was sufficient support from respondents on continuing to develop and assess the options for reforming the CM and introducing a revenue cap and floor mechanism for flexible assets. However, the majority (51%) of respondents disagreed that the government should continue to consider introducing a supplier obligation for flexibility, with some noting that this would place an inappropriate risk on suppliers. Respondents also highlighted the importance of aligning the REMA programme with retail market reform. Based on this, the government decided not to pursue a supplier obligation as the main mechanism for flexibility in the short-term. However, it said that it will continue to assess the role of suppliers in delivering demand side flexibility in support of the delivery of other REMA options.

Capacity adequacy

In order to further ensure capacity adequacy within electricity market arrangements, the first consultation considered a range of issues and options to reform the CM and align it with broader decarbonisation objectives. Following the first consultation’s response, the government decided to take forward only two options in a standalone capacity, further pursuing both an optimised capacity market and centralised reliability. Of the remaining options, capacity payments and decentralised reliability have been removed entirely while targeted tenders and strategic reserves are being considered only in conjunction with other options.

55% of respondents agreed that REMA had sufficiently considered all credible options for capacity adequacy reform and identified optimising the CM and focusing on short-term reforms as the preferable avenues for doing so. For some of those who disagreed (19%), questions were raised regarding the CM’s role within a decarbonised power system while others suggested focusing on driving grid infrastructure investment, incentivising demand reduction, and integrating flexible technologies. In general, it appeared that further optimising the CM is a key priority area for most (85%) respondents, with many finding that an evolutionary approach to CM reform would be less disruptive than trying to implement an alternative to the current system.

Going into further detail, the first consultation sought to understand whether separate auctions or multiple clearing prices were preferable to meet REMA’s objectives. Of the 69 respondents, the vote was “almost evenly split” with a few suggesting a combination of both. The first consultation also sought views on whether the CM was sufficient on its own and if other major reforms were needed to meet REMA’s objectives. On the former point, responses were mixed, with some noting that the role of long-duration storage and flexible technologies would be crucial while others considered the CM adequate providing that existing issues were addressed, and it is continuously improved. On the latter point, recommendations ranged from the need to improve grid infrastructure investment, the role of peak demand, and the support needed for flexible technologies.

68% of respondents agreed that REMA should continue to explore Centralised Reliability Options (CROs), though many noted that it was not their preferred option. Regardless, some agreed that CROs could provide a better incentive to generators to be available and could help to create improved pricing stability during stress events. Meanwhile, some of those who disagreed with CROs argued that they had previously been discounted as part of the Electricity Market Reform whilst others noted issues with CROs in international markets. In contrast to support for CROs, the government has decided not to take forward Decentralised Reliability Options (DROs) as 60% agreed that they could hinder investment, discourage participation in the CM and that they would be too administratively complex to implement.

Of the remaining options, 58% agreed with the government’s minded-to decision not to continue with capacity payments, citing lack of cost-effectiveness, and possible inability to incentivise new build capacity alongside concerns surrounding investment incentives, revenue certainty, and insufficient competition as reasons. Similarly, targeted tenders or targeted capacity payments were not taken forward, with 63% of respondents agreeing with the government’s minded-to position not to carry this option forward. Despite being largely sceptical, 60% felt that a strategic reserve should not be ruled out, and that it could be useful in conjunction with another option. Despite this, the government has stated that a strategic reserve is “not our preferred option”, progressing it only “if the evidence suggests that it is absolutely necessary.”

Operability

The first consultation considered a range of options for ensuring operability of a low carbon electricity system. This included continuing with existing policies, incremental changes to existing arrangements, developing local ancillary services markets, modifications to the CfD and or the CM and co-optimisation with the wholesale market.

The majority (57%) of respondents agreed that the government has considered all credible options for reforming operability. The majority also considered that continuing with the status quo was not a viable option, with 47% of the opinion that existing policies would not be sufficient to meet the government’s objectives for operability.

A large majority (67%), on the other hand, supported the measures outlined for enhancing existing policies, with most supporting at least one of the sub-options for enhanced existing policies, a “significant” minority supporting all four sub-options and very few opposing all four sub-options. In terms of options and interventions that could facilitate the development of local ancillary services markets, support was received for improving the level of coordination between the Electricity System Operator (ESO) and distribution network operators (DNOs) in transitioning to a low carbon system. 67% of respondents also expressed that they believe the CfD in its current form discourages the provision of ancillary services and saw merit in amending the CfD to incentivise ancillary services. With regards to whether the CM should be amended to incentivise the provision of ancillary services, respondents were fairly evenly divided. Responses were also mixed on whether co-optimisation should be introduced to wholesale markets.

Having considered the feedback received, the government decided to retain all options relating to operability (Figure 1).

Options across multiple market elements

Respondents broadly agreed that options to consider a payment on carbon avoided (Dutch subsidy scheme) for either mass low carbon power or flexibility should not be taken forward, with a number of concerns raised around complexity and uncertain benefits. As such, the government decided to discount these options from the REMA programme. The majority of respondents (52%) also disagreed that the government should continue to consider an Equivalent Firm Power auction to drive mass low carbon power, with many expressing concern that this would increase risks on renewable generators, leading to higher strike prices and overall system costs, without compensating benefits in terms of efficiency or security of supply. As such, it also decided not to consider this option further.