On 12 March 2024 , DESNZ published its second REMA consultation, alongside an Options Assessment document. See our reaction to this, here.

An overview of the second REMA consultation is covered below. We cover the consultation in more detail through our Regulatory Alert service and Industry Essentials service. For those that currently are not subscribed to these services and are interested in receiving them, please contact enquiries@cornwall-insight.com.

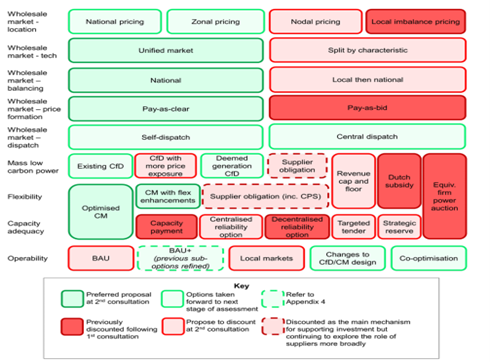

Within the second consultation, DESNZ highlights the progress made in the REMA programme to date, providing an overview of how the options for reform have progressed from the first consultation (Figure 1).

Source: DESNZ

DESNZ also notes that this second consultation aims to create a clear direction of travel for future GB electricity market arrangements, seeking views on specific proposals and a short-list of remaining options. It adds that in this next phase, it plans to consider both the remaining options and the best overall system design.

Challenges

DESNZ notes that the case for change in the first REMA consultation identified key challenges that the future electricity system will face, including the need for increasing investment, increasing system flexibility, providing efficient locational signals, retaining system operability, and managing price volatility. As part of this, it also concluded that while the existing electricity market arrangements have been effective in delivering the first phase of power sector decarbonisation, they are no longer fit for purpose to deliver a decarbonised power system by 2035 or meet the wider 2050 net zero target.

Within its second consultation, DESNZ highlights that it has since built on this case for change, which is now based on four key challenges facing future electricity markets. These are set out in more detail below, with views sought on the proposals outlined under each challenge.

DESNZ notes that this challenge-led approach has helped it to significantly narrow down the remaining options. It adds that it recognises electricity market reform is ultimately a whole-system problem and that focusing on any one single part of the system without consideration of how it interacts with other parts is likely to lead to sub-optimal outcomes. As such, within the Options Compatibility and Legacy Arrangements section of the consultation, it sets out an initial assessment of the interactions between the policy options.

Challenge 1: Passing through the value of a renewables-based system to consumers

Under the current market design, electricity in GB is exchanged through wholesale markets, operating on the principle of short-run marginal pricing, where electricity prices are established on the basis of the variable cost of the marginal plant, which is the most expensive power generation facility needed to meet the current electricity demand. Given the current generation mix, gas generation frequently sets the price and has, in recent years, exposed consumers to international price shocks. Increasing the proportion of domestic renewable capacity has the potential to further shield consumers from this volatility as gas will set the price less frequently.

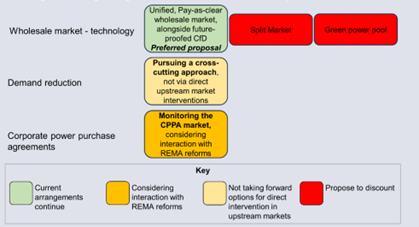

DESNZ has explored the potential advantages of alternative market structures and reforms to the current wholesale market, with the aim of accelerating renewable energy development and delivering benefits to consumers. DESNZ is now proposing to maintain a wholesale market based on short-run marginal pricing and continue accelerating the deployment of renewables through a future-proofed Contracts for Difference (CfD) scheme (Figure 2), as the latter will ensure that a diminishing proportion of renewable and nuclear generation will be paid at a marginal price set by gas. While discounting the creation of a Split Market (which would entail the establishment of separate markets for dispatchable and non-dispatchable technologies respectively) and Green Power Pool (which would consist in a dispatched pool for renewable electricity), DESNZ highlights the role of consumers in purchasing and promoting the development of renewable power within the existing market structures. This includes through Corporate Power Purchase Agreements (CPPAs), which offer a path to develop renewables outside of the CfD. While DESNZ does not currently perceive the need of government intervention, it intends to closely observe the evolution of the CPPA market and its interaction with REMA reforms.

Source: DESNZ

Challenge 2: Investing to create a renewables-based system at pace

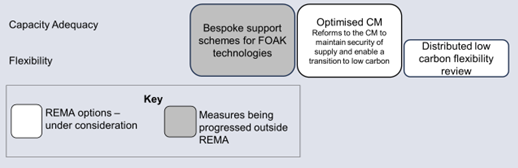

In the years ahead, DESNZ anticipates that substantial investment in new renewable generation will be needed to achieve the 2035 target for electricity system decarbonisation. As renewable support schemes will be crucial to achieve this outcome, DESNZ has considered potential changes and reform to the CfD scheme, which is the government’s main scheme for supporting investment in renewable electricity generation. In this respect, DESNZ is focused on maintaining investor confidence while ensuring value for consumers. However, it recognises the necessity for the CfD to adapt to a future system where a greater proportion of our electricity will originate from intermittent renewable sources, often located far from demand. DESNZ is considering several options for CfD reform (Figure 3), seeking inputs on how these options can tackle future challenges in renewable investment. Two of the options for CfD reform (capacity-based CfD and partial CfD) have been introduced for the first time through the second consultation and so have not been previously consulted on or discussed.

Furthermore, it is assessing how these reforms align with REMA assessment criteria and their interaction with ongoing wholesale market reforms. Two of the CfD reform options included are deemed payments, where generators would be paid on their potential output rather than their actual output, and capacity payments, where generators would be paid on their capacity and would be required to trade power on a merchant basis. DESNZ is also proposing additional reform that could be implemented concurrently with – or as alternatives to – payment structure reforms. For example, under partial CfD payments, only a percentage of an asset’s total capacity would be covered by a CfD for new projects and the rest of the capacity would be required to trade on a merchant basis. In terms of next steps, DESNZ highlights that the subsequent phase of REMA will involve a narrower and more thorough evaluation of the remaining CfD reform options, with the purpose of identifying a preferred option.

Source: DESNZ

Challenge 3: Transitioning away from an unabated gas-based system to a flexible, resilient, decarbonised electricity system

While recognising the need to shift away from the current unabated gas-dominated system to the flexible low carbon system of the future, DESNZ anticipates that a limited amount of new build gas capacity will be needed in the short term to ensure a secure and reliable system, for example to replace existing generation capacity as it expires. While low carbon technologies like power carbon capture usage and storage (CCUS), hydrogen-to-power (H2P) and long-duration electricity storage (LDES) are scaling up, mature gas technologies currently remain the main source of capacity. In addition, views are sought on an optimised Capacity Market (CM) (hence retaining and optimising the CM as the capacity adequacy mechanism for the GB electricity system) with a single auction, where the government proposes the introduction of a minimum procurement target (minima) to support investment of low carbon flexible technologies (Figure 4).

Source: DESNZ

Note: FOAK = First of a Kind

Challenge 4: Operating and optimising a renewables-based system, cost-effectively

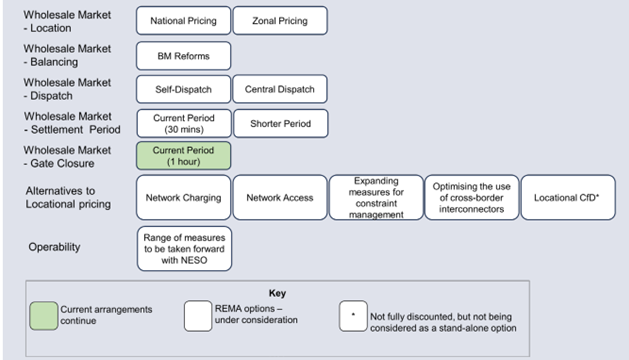

As GB moves towards a low carbon electricity system, power generation is increasingly located farther from areas of demand. This situation often leads to a geographical mismatch between supply and demand (for example, with generation situated in the North of Scotland and demand in the Southeast of England), creating additional strain on network infrastructure and resulting in a greater number of periods of constraint and curtailment. Because of existing policy and market arrangements, developers are not required to adequately factor in location in their decision making. However, consumers ultimately bear the cost of resolving inefficient dispatch outcomes. Thus, DESNZ is investigating further options to improve the effectiveness of locational signals, in particular by seeking views from stakeholders regarding zonal pricing options (Figure 5).

Locational signals could encourage power generation and demand, where feasible, to locate in network areas where they can offer most value to the system and operate more efficiently, hence reducing system costs. Thus, the locational value of electricity would be embedded into the wholesale price, reflecting the equilibrium between supply and demand as well as the available network capacity at each specific location. While the first consultation considered two forms of locational pricing, zonal and nodal, only the former is being considered moving forward. DESNZ deems that zonal locational pricing could provide key benefits, such as creating a more efficient system, lowering consumer bills, unlocking the potential to optimise whole-system flexibility and boosting economic growth. However, it also acknowledges risks, including potential increases in the cost of capital, implementation challenges, uncertainty around long-term liquidity, and adaptability.

Source: DESNZ