Having alluded to the need for electricity market reform in several policy documents over the last few years, and following a commitment made in its April Energy Security Strategy, on 18 July the government published its Reform of Electricity Market Arrangements (REMA) consultation.

This comes after the best part of two decades of the British Electricity Trading and Transmission Arrangements (BETTA, Figure 1) that have been in place as renewables have gained critical mass. With BETTA creating an often carbon heavy price, BEIS argues, and many agree, that there is a case for change to the current arrangements and it can be argued that they are not fit for purpose in facilitating decarbonisation of the system by 2035, while maintaining energy security and affordability for consumers.

Hallucination

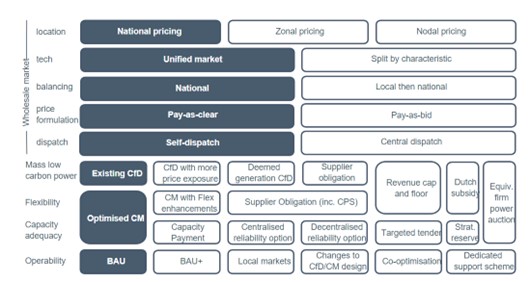

At this stage, the options for reform set out by BEIS are broad, with everything on the table the core outcomes the future power system will need to deliver, including a net zero wholesale market; mass low carbon power; flexibility; capacity adequacy; and operability. The scope puts support schemes and balancing as well as the corer wholesale pricing mechanism in scope. This is logical given the potential interactions between different pricing and other mechanisms to reduce the potential for unintended consequences.

Options for changing the wholesale pricing mechanism

Potential reforms to the wholesale market include splitting the market into separate markets for variable and firm power; moving to locational pricing – either zonal or nodal; reorienting the market around local, distribution system markets (where the national market clears in the light of the local distribution systems, the reverse of the BETTA design); and moving to pay as bid rather than the existing pay as clear.

In contrast, maintaining the fundamentals of the status quo is suggested but with what are presented as incremental reforms, such as a move from self-dispatch to central dispatch and changes to settlement periods and gate closure.

Many of these options would likely take several years to design and implement as they would require fundamental redesigns of systems and would have ‘significant’ implications across the market. This includes changes to business models and support schemes, infrastructure and system changes for the System Operator, and amendments to retail market regulation. There is momentum behind a nodal Locational Marginal Pricing approach, but while there is acceptance in industry of the need for reform there are still plenty of questions on whether it should be the preferred way forward.

Options for delivering mass low carbon power

Whatever the changes to the wholesale pricing mechanism, support schemes will be needed to incentivise low carbon generation. Most of the options set out in this regard are based around the existing Contracts for Difference (CfD) scheme and whether this should be retained, or a variation of the scheme put in place. This includes an amendment to increase price exposure either during the length of the contract or shortening contracts to increase the amount of time that generators are fully exposed to market signals. It is also proposed that the CfD could be based on deemed generation rather than their actual generation.

Drawing on what is currently in place for interconnection, a revenue cap and floor is another option set out, under which generators would be guaranteed a minimum revenue in each period and pay back a proportion of the excess in circumstances where revenue achieved is above the cap.

While all these options retain competitively allocated, long-term, private law contracts between generators and a government-owned counterparty, one exception is the introduction of a decarbonisation obligation on electricity suppliers. This would require them to procure green electricity directly on behalf of their consumers, with a trajectory set by the government of maximum carbon intensity of electricity that suppliers can sell to their customers. Apart from retaining the current CfD, all options would increase the role of the market, whether through greater exposure of those contracts to prices or in the allocation of those contracts, to minimise costs passed to consumers.

Options for delivering flexibility

It is suggested by BEIS that current market arrangements do not maximise the potential for the full range of flexible technologies, a ‘twin-track’ approach to market reform for flexibility is being considered. This includes the need for strong granular operational signals from the wholesale and balancing markets but also the need to ensure flexibility can attract the investment it needs to deploy.

The options look at whether changes to investment signals would enable greater competition between flexible assets. This includes a revenue cap and floor, under which flexibility assets would compete for a guaranteed minimum revenue (floor) for each period, with a cap also introduced to protect consumers from excessive profits. Flexible auctions within the Capacity Market are also being considered, which would be open to all low carbon technologies which meet an agreed set of flexibility criteria. Introducing multipliers to the clearing price within the Capacity Market is another option, where only low carbon capacity meeting the flexibility criteria would be eligible, and multipliers would be applied to their clearing price valuing flexible characteristics, such as response time, duration of capacity and location.

Lastly, a flexible-focus supplier obligation is set out. Whatever option is chosen, the ideas here underline a fundamental tension: volatile prices are seen as a good thing to incentivise the deployment of flexible assets, yet our cap-driven retail market hinges on single and two-rate tariffs. At what point do price signals become too volatile to pass through to customers? And if so, what is the mechanism for shielding them?

Options for delivering capacity adequacy

Market arrangements will need to secure sufficient investment to enable system balancing at all times, the importance of which has been emphasised by recent geopolitical events. As the system becomes increasingly dominated by renewables, firm capacity will be pushed out of the wholesale market, with what BEIS terms “significant” investment needed to provide replacement firm capacity. While the Capacity Market provides a mechanism for ensuring capacity adequacy and has worked well, it does not provide incentives for the kind of low carbon, flexible, firm power needed to complement renewables.

As such, a range of capacity mechanisms and other options are being considered. This includes making changes to optimise the existing Capacity Market for the participation of low carbon capacity, without jeopardising security of supply, with two main variations: having separate auctions, to the main capacity auction, for low carbon new build or refurbished assets; and having a single auction, as there is currently, but with different clearing prices depending on capacity type. Another option suggested is a strategic reserve model where a central authority auctions a certain amount and type of reserve capacity on top of what the market is expected to provide, with successful providers receiving payment at their bid price.

A Centralised Reliability Option model is also set out whereby the incentive to provide power is signalled through the level of wholesale market pricing rather than by targeting a system stress event, based on a ‘call option contract’, which gives the buyer of the contract the right to buy a commodity at a predefined price. The Transmission System Operator (TSO) determines the amount of capacity to be auctioned and, in return for a reliability premium, secures the right to buy electricity from the assets on the wholesale market at a ‘strike price’. While a Decentralised Reliability Option model would work in a similar way, this strips out the role of the TSO, with suppliers required to secure reliability options to meet their peak demand through direct contracts with capacity providers. Two further options include a capacity payment model, which is a market-wide approach that sets an explicit price for capacity, and targeted tender, which is a centrally coordinated process to secure the construction of a specified quantity of new capacity, with tenders tailored to meet specific requirements.

Options for delivering operability

As fossil fuelled generators are largely replaced with low carbon generation, there is a need to promote investment in low carbon ancillary services. While continuing with the status quo is one of the options set out, incremental changes to existing arrangements are also proposed, such as giving the ESO or Future System Operator the ability (or obligation) to prioritise zero/low carbon procurement and aligning Capacity Market and CfD tenders with those for ancillary services. Changes to the CfD and Capacity Market are also suggested to remove disincentives for assets supported by the scheme to engage in ancillary services market to include obligations or incentives to provide ancillary services, respectively. Other options propose developing local ancillary services markets and giving a greater role to distribution network operators, and co-optimisation of ancillary services, which would be considered as part of broader wholesale market changes which involve central dispatch, such as nodal pricing.

Options across multiple market elements

Two options are proposed, which cover multiple elements of market design at once. This includes an auction by cost of carbon abatement, as per the Dutch SDE++ scheme, and an Equivalent Firm Power (EFP) auction. Having assessed the cost of carbon abatement auction, BEIS is only minded to take this option forward for further exploration as a potential way of structuring support for investment in low carbon flexibility. It is not minded to pursue this option for mass low carbon power, as there does not appear to be significant benefits over the existing CfD scheme.

Home at Last

This review opens the prospect of the biggest overhaul in the GB power market for a generation. The scope of the review is extremely wide-ranging and goes beyond the way that market prices are calculated, also bringing in areas such as the Capacity Market, CfDs and balancing services, and how consumers can play a more active role in the transition. The government expects to have a roadmap in place ahead of the next general election in 2024 which is very ambitious considering that the last major change to the arrangements took four years to implement, requiring primary legislation and a whole new contracting framework.

While the options appear to be complex, it is worth noting that just a few important principles will define any new market design as some elements will not work together. The risks associated with this will vary for different parties under different models, with winners and losers yet to work out who they are. One thing we do know for now though, is that status quo is more or less off the table, with the potential for the terms of trade for generators, consumers and investors to change substantially.

If you would like to access all your services in our customer portal, CATALYST, please click here.